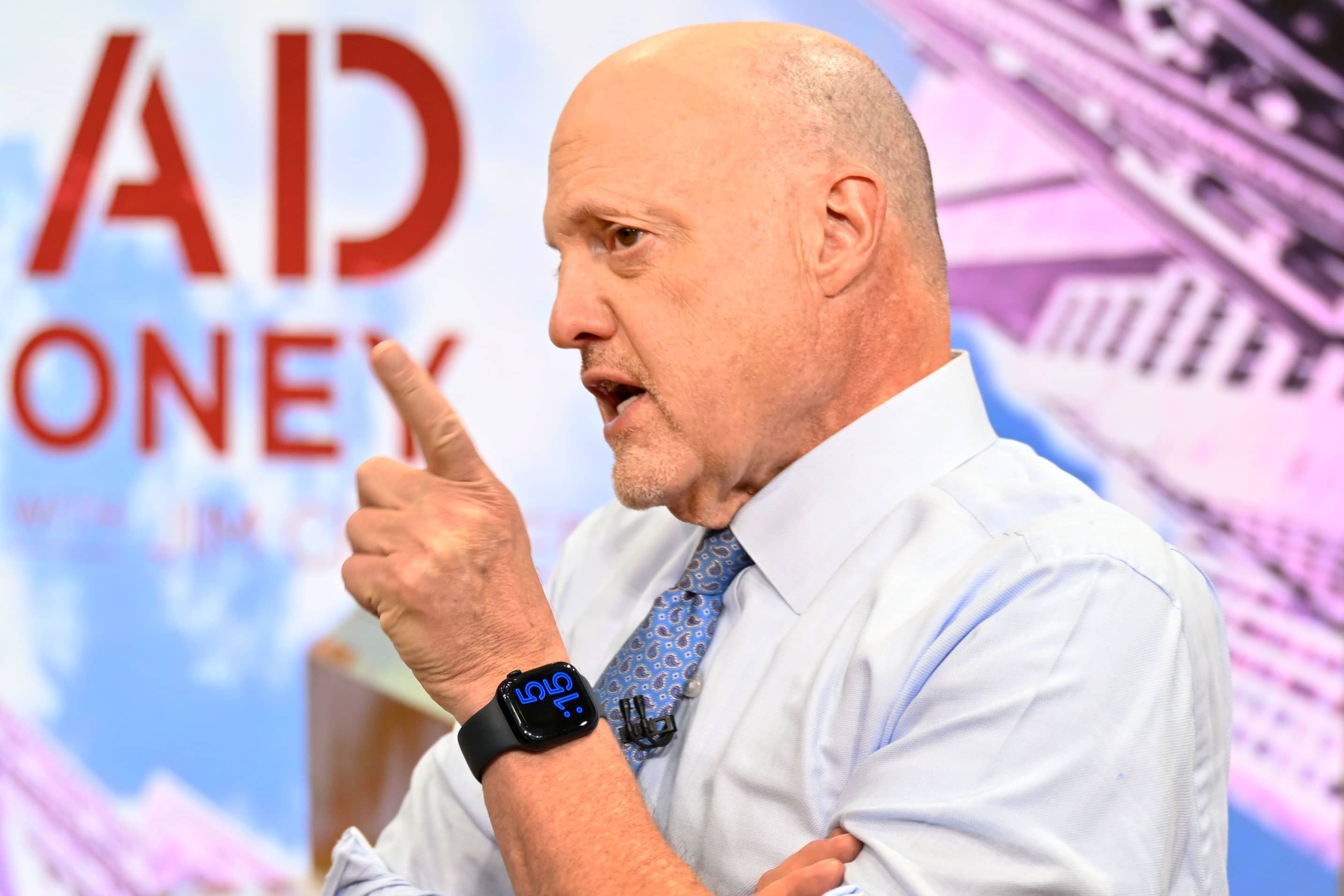

After a sour day in Washington and on Wall Street, CNBC’s Jim Cramer warned investors that lawmakers will inevitably cost them money as debt ceiling negotiations drag on.

“Get ready for our politicians to lose you some more money,” Cramer said, referencing the earlier impasse surrounding the debt ceiling in 2011. “They hurt you then. They aren’t done hurting you now. But unless you trade full time it’s very hard to get out and get back in early enough for it to make a difference, which means most of us need to take the pain.”

Market watchers are also weighing the news of the emergence of a new Covid-19 variant in China, he said. It’s unclear whether this new wave will prompt Beijing to impose new travel restrictions, many of which eased up several months ago.

“We don’t know if travel will be banned or restricted, although the Macau casino stocks are trading like it’s gonna happen,” Cramer said. “And we don’t know if the psyche of the recently ebullient Chinese consumer will be impacted.”

With 2011’s fitful debt ceiling negotiations ringing in his ears, Cramer is pessimistic about lawmakers’ ability to come to a deal before chaos reigns.

“Even though we ultimately got a deal [in 2011] and averted the worst-case scenario, the standoff was enough to make Standard & Poor’s downgrade our government’s credit rating,” he said.

Cramer considered the merits of selling stocks before the potential market swoon, but worried that many will not be able to buy them back fast enough to see real gains.

“I would hate to advise you to sell and then buy back later, though, because we don’t know if you’ll be able to get back in before the all-clear,” Cramer remarked. “That said, if you think our leaders are serious about making a deal, then it might be worth trying to sidestep the coming decline — and if we’re following the 2011 script, there’d be about a 12% decline from here until the bottom.”

Jim Cramer’s Guide to Investing

Click here to download Jim Cramer’s Guide to Investing at no cost to help you build long-term wealth and invest smarter.