Insect protein has been recognised as a food source from a traditional point of view for centuries, and even by modern standards the use of this as an alternative protein source to make more modern product interpretations such as snacks and pastas has been in the works for at least around a decade.

Thank you for reading this post, don't forget to subscribe!However, many years on the sector remains firmly in the ‘nascent’ stage, in obvious contrast to other alternative protein sectors such as plant-based and precision fermentation which have grown leaps and bounds in terms of commercialisation in the past decade –FoodNavigator-Asia takes a closer look at the challenges and hurdles standing in the way of faster prowess for this industry.

One theory has been that the sector came off to a poor start due to teething issues with formats and innovation, coupled with a lack of support from big brands and retailers over the years.

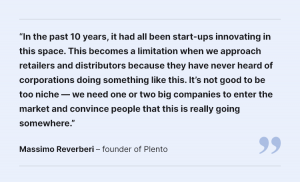

“It’s been about eight to 10 years since many start-ups around the world started doing insect products, [and] the start-ups in this field have really struggled,” Thailand-based insect snack brand Plento Founder Massimo Reverberi told us.

“One of the initial issues was that many of them worked with whole insects, and then many of them focused on energy bars which is a very competitive category as people in fitness have so many options, and whilst it is true that insects contain a lot of protein, focusing on just this angle means that these insect-based products are not completely competitive with what already exists.

“More problematically, in the past 10 years I have never seen a big company do much with insects as it’s always been small start-ups and these big brands are waiting a few years for them to innovate and see what happens before entering the sector.

“This has becomes a limitation because when you approach the retailers, the distributors, the supermarkets, it has become common to hear them say, ‘oh, I’ve never heard of Nestle or Coca-Cola going into something like this’ – not to mention to enter a supermarket, you need to be a giant company or you pay shelf fees and listing fees which start-ups probably cannot afford.”

These challenges have strongly contributed to the sector being unable to take off in a major way thus far, and this is a major hurdle that brands such as Plento believe needs to be removed before significant progress can be in sight.

“[In general], start ups don’t like the corporations’ [way of doing things] but at the same time being too niche and having no corporation doing the same thing is not a good business model too,” he said.

“We likely need at least one or two big brands just to show the market and business people that this is really going somewhere [in order to convince them to give smaller brands a chance too].

“Otherwise, the insect sector is still in the nascent stage where it has been for many years [and it is impossible to say there will much change if things stay status quo] – some people say edible insects as the next big market will happen in three years, while some say it will happen in 20 years, all of this showing that right now so no one can be sure about the timeline for progress.”

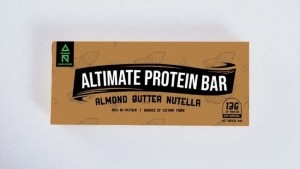

This point of view was concurred by Singapore-based cricket protein foods firm Altimate Nutrition, which also initially started with a cricket protein bar launch.

“I definitely think it would help if a big name suddenly came into the picture for insect protein – People usually follow the bigger players, it’s the same for most markets,” Altimate Nutrition Director and Co-Founder Hiew Yuen Sheng told us.

“We need to have a big company to really adopt this, to take up this challenge – and that’s where they could play a pivotal role or even convert a few other companies.

“[It would also help with] the cultural perception and consumer acceptance that has really been holding the sector back.”

In terms of participation in the insect protein sector, the most prominent big brand in the APAC region that has publicised investments here has been Thai Union – but executives from the MNC have highlighted this as a longer-term opportunity and not a short-term one.

“A lot of people are looking at alternative protein as a way to enhance margins [but] this may not really be the correct concept,” Thai Union Head of Global Business Development of Seafood Alternatives Gerben Kamps told us.

“We are definitely optimistic about the long-term opportunity for alternative proteins such as plant-based and insect-based protein – but it is a sector that needs investment and persistence to success, and in no way a shortcut to making profits.

“There is a clear and obvious need for the protein transition – but realistically, everyone needs to be prepared that it will likely take longer than perhaps originally expected.”

Under its Corporate Venture Capital Fund, Thai Union has invested into insect-based firms such as fruit fly larvae firm Flying SpArk and black soldier fly larvae pet food firm Orgafeed.

Regulation imprecision

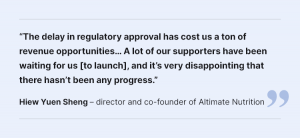

From a regulatory perspective, Altimate Nutrition has faced various challenges in terms of regulatory approvals for its products despite being located in a market with one of the most advanced novel food policies in the world.

“The Singapore Food Agency (SFA) was supposed to give the green light for consumption in the second half of 2023, and it’s really disappointing that they didn’t really keep to their promise,” Hiew said.

“Whenever we ask them about it, it’s always a very vague answer – They will tell us to check their website for any updates on novel foods.

“For the past few months, we have been chasing for this regulatory restriction to be approved, and so far we are only able to align ourselves to do more R&D as well as partnership with restaurants.

“We would say that the delay has really impacted us in our business because we were preparing a lot for launch in January and with SFA not keeping to their word, it actually cost us a ton of revenue – for example, we cannot do pop-ups anymore, which were supposed to be planned for January.”

Vietnam-based insect protein firm FlyFeed stressed the importance of regulations when it comes to both commercialisation and consumer acceptance, highlighting that there exist both good and bad sides to stringent governance of the sector.

“Regulations helps the market because it puts a lot of focus on the safety of food products, particularly new products, and this carries a lot of weight with consumers,” FlyFeed Founder and CEO Arseniy Olkhovskiy told us.

“The achievement of regulatory approval from a consumer’s perspective means that these products are safe and will go a long way towards consumer acceptance – and indeed in Asia right now some countries already have regulations in place of insects as food such as Thailand, China, and it is developing in Vietnam too.

“In Europe this is already strictly regulated and there are pros and cons to this as it gives consumers that certainty, but also makes it more difficult for companies to enter the market just like that.

“Either way, there is still a strong argument for insect-based protein as an alternative protein source especially here in Asia where many developing countries are located, because as incomes start to grow so will the demand for protein consumption due to its role in forming healthy human bodies – so it is inevitable that consumers in Asia will need more and more protein over time.”

Watch the video below to find out more.

Consumer acceptance

Olkhovskiy’s focus on regulations as a crucial component of consumer acceptance is not without reason, linking back to many firm’s initial and often erroneous assumption that Asian markets are automatically inclined to accept insect-based foods just because there is a cultural and traditional history of this in the region.

“Many firms tend to have this misleading impression that Asia as a region with a long history of insect consumption for health reasons will automatically accept an insect food brand that enters the market – but history has already shown that this is not true,” he said.

“There have been lots of brands that tried this in Asia, and this strategy has almost never worked as well as expected – this is because regardless of the potential health benefits and history here, there are many different groups of consumers with different consumption patterns, [but none] that fit into this as-is.

“For example, the more conservative part of Thailand or Vietnam would have no issue with insect consumption as this what they do on almost a daily basis – but they would not be interested in paying a premium for well-packaged, fancy-looking, western-style insect products.

“Then for consumers living in big cities, they have a modern lifestyle and would not be big fans of insect products, because it’s not culturally accepted for them, and they would prefer other sources of protein over insects.”

This is a similar quandary faced by Plento, which has targeted South Korea as the first market for its snacks despite being based in Thailand due to the consumer demographic.

“Most of the time consumers that already eat insects come from the country, they just collect them and fry them as a snack but have no idea of nutritional or sustainable properties, just treating these as a street food,” Reverberi said.

“But if you make an energy bar with an innovative ingredient like this, the consumer is going to be someone urban, younger to middle-aged, who is really into nutrition and sustainability, and who is willing to pay a premium price for that.

“So the target consumer is completely different, and the presence of consumers who have been eating insect in a country traditionally does not help me, whereas if I tell a Bangkok consumer to eat something with insects in it, he would likely say ‘that’s disgusting’ or ‘I’m not a farmer from the country’ – so there is also a social status connected to it.”

East Asia as first markets

On the contrary, Japan and South Korea have been recognised as the markets with the fastest, if not the most, potential for insect-based products, mostly due to regulatory reasons.

“In Korea and Japan, the government and the rules are very advanced and open to innovation [especially when it comes to insect protein],” Reverberi added.

“Japan and Korea have always been okay with insects [and I previously] exported cricket pasta to both Japan and Korea years ago, so already have the experience with consumers there and known they are really okay with this.”

Altimate Nutrition is also observing a similar trend in this region whilst waiting for regulations in Singapore to come through, though it still holds out hope that more South East Asian markets will show potential as well.

“The main areas we see with market potential for insect protein in Asia would be countries like Japan, South Korea and China as well as neighbouring countries such as Indonesia, Thailand and Vietnam,” Hiew said.

“These countries have a history of insect consumption and it’s legally allowed in their country – but only a small proportion of the population consumes insects as food.

“This is likely because the education is still not there and the culture is also still not there, so we [would be coming in] at a very early stage.”

Price the biggest driver

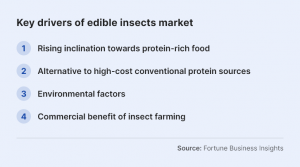

Despite the challenges faced by the sector, many companies continue to place high hopes on it due to its affordability and pricing potential, a crucial factor given rising inflationary costs in the food and beverage sector today.

“There has continued to be a search for insect protein with global population issues arising and so on, so definitely there will be the need to source for alternative proteins to supply everyone,” Hiew said.

“Additionally, going to supermarkets such as Cold Storage in Singapore will show that there has been a big difference in prices between this year and last year, showing that inflation is really taking place and the cost of meat or protein is only going to increase further.

“So looking at insect protein, economics-wise it’s very cheap to produce this and will take up less space, less water and less food resources too, plus additional benefits for the environment such as greenhouse gas emission reduction.”

Olkhovskiy concurred, concluding that this affordability is going to be the biggest advantage of all for the insect protein sector.

“The ability for this to be produced at super cheap costs will be insect protein’s biggest advantage, combined with the potential to make products that have almost the same taste as conventional meat,” he said.

“Adding on the potential to give better nutrition at three to four times cheaper than say chicken [and] the wide range of potential products from alternative meat to bakery that can be made healthier and cheaper, there is a strong value proposition to be found here.”