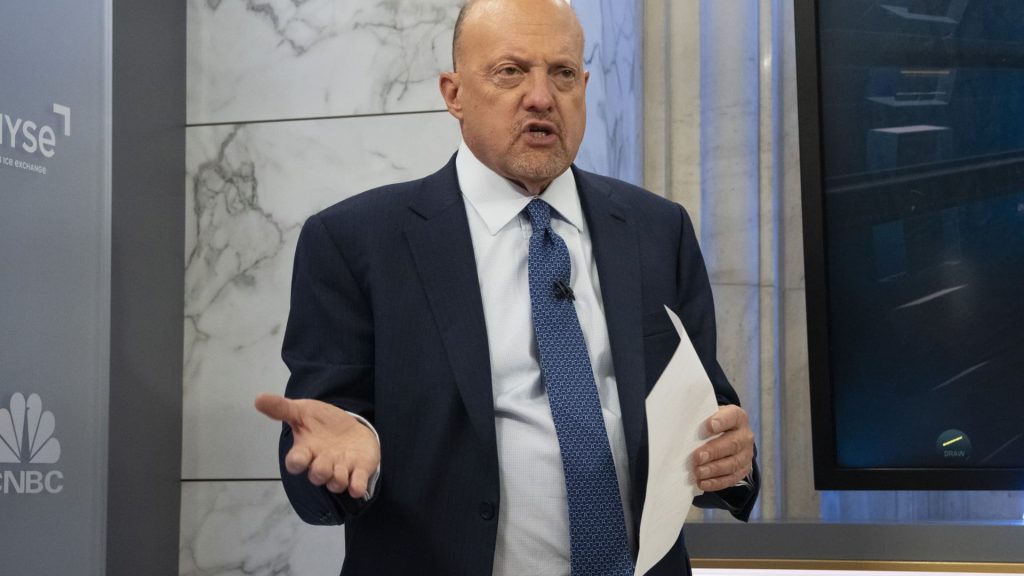

After President Donald Trump issued a 90-day pause on most of his “reciprocal” tariffs and stocks staged a historic rally, CNBC’s Jim Cramer on Wednesday shared four lessons learned from the week of market turmoil.

U.S. markets surged after Trump dropped his latest tariffs to a 10% rate on all countries except China. The Dow Jones Industrial Average rose 7.9%, the S&P 500 gained 9.5%, the Nasdaq soared 12.2% and the Russell 2000 bounced 8.7%. All of the indices are still down significantly from their highs this year, but they clawed back much of the losses suffered since Trump initially declared the tariffs last week.

1. Nobody ever made a dime panicking

People who got out during the sell-off made a rash, emotional decision, Cramer said, and they lost out on Wednesday because of that. Stockholders’ annual gains typically only come from seven days in a year, he added. Wednesday was one of those days, he said, and those who stayed the course won big.

“Learn to take the pain,” Cramer said. “Staying the course is how you make the biggest money.”

2. Bulls make money, bears make money, pigs get slaughtered

Cramer said the market action punished investors who’ve stayed negative, as well as short sellers and hedge funds that got greedy in the past few days. Conversely, it rewarded people who stuck with their investments even as volatility skyrocketed.

Wednesday, he said, was “one of the greatest short squeezes in history.”

3. The president likes drama — you won’t get certainty

While investors can’t expect stability with Trump in charge, Cramer said, they should assume that the president will eventually change course if his policies are destroying stocks. Trump is determined to change U.S. trade relations, Cramer said, but he’s not trying to wreck the economy.

The White House didn’t immediately respond to a CNBC request for comment.

4. Don’t bet against good companies

Shares of mega-cap tech corporations like Apple and Nvidia were some of the biggest losers during the market’s recent slide, due to their exposure to tariffs. But these companies have achieved great success for a reason, Cramer said, and investors who write them off at their lows do so at their own risk.

Apple stock jumped over 15% on Wednesday, despite the company’s vulnerability to China tariffs, and Nvidia shares skyrocketed nearly 19%.

“If you do hate them, sell these stocks when they’re up, not when they’re down,” Cramer said.

Jim Cramer’s Guide to Investing

Sign up now for the CNBC Investing Club to follow Jim Cramer’s every move in the market.

Disclaimer The CNBC Investing Club Charitable Trust holds shares of Apple and Nvidia.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com